20 Apr

Due Dates of Income Tax Filing FY 23 24

Introduction:

Tax filing season is here, and knowing the deadlines and steps can make the process smoother. Whether you're an individual or a business owner, understanding when and how to file your taxes is crucial. This blog post will break down the due dates and essential details for filing your income tax returns.

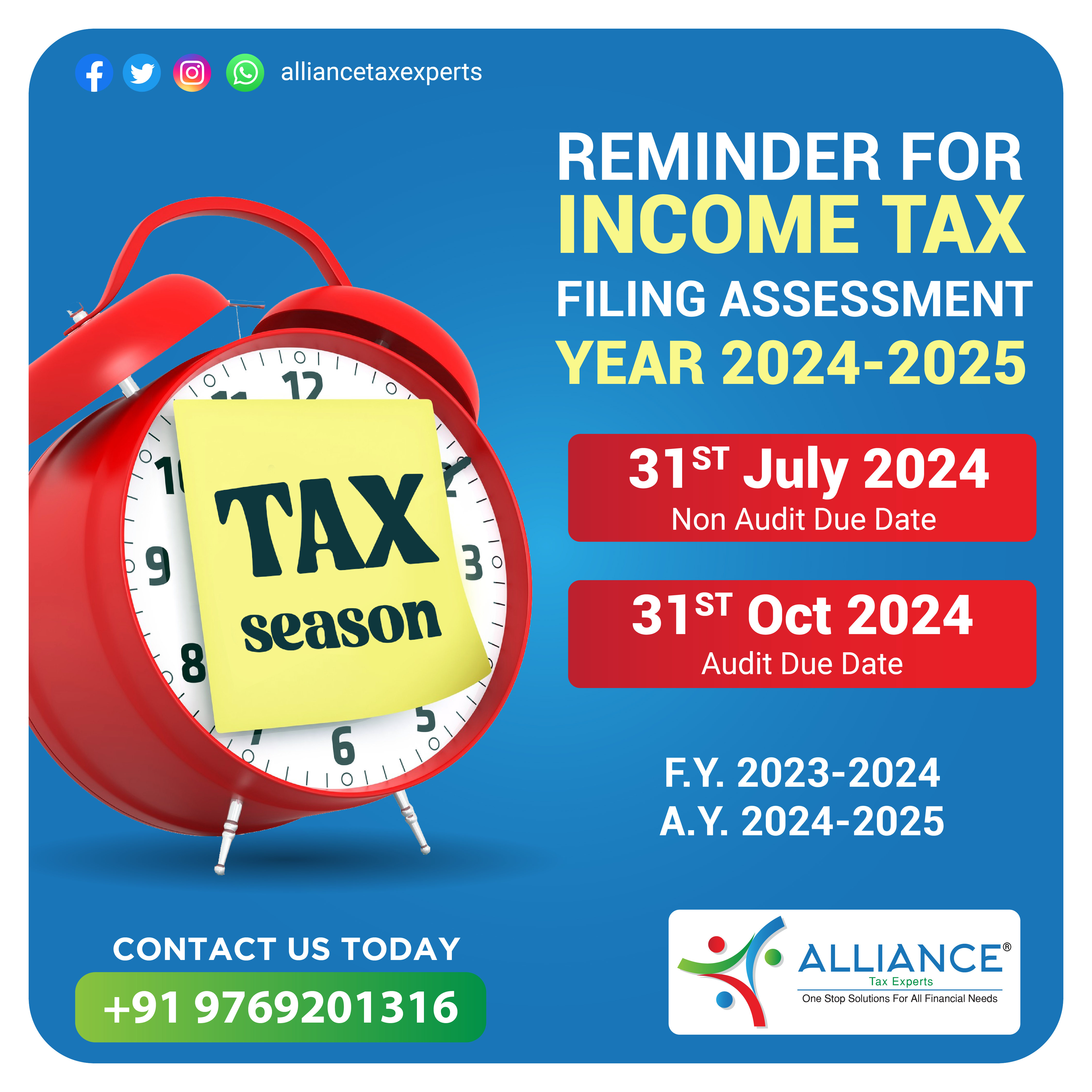

Non-Audit Tax Filing (Due Date: 31/07/2024):

For individuals and businesses not needing an audit, the deadline to file your tax returns is July 31, 2024. This applies to self-employed individuals, proprietors, partnership firms, private limited companies, freelancers, and professionals. By meeting this deadline, you avoid penalties and complications.

Audit Tax Filing (Due Date: 31/10/2024):

If your income exceeds a certain limit or you must undergo an audit, you must file your tax returns by October 31, 2024. This applies to self-employed individuals, proprietors, partnership firms, private limited companies, freelancers, and professionals. It's crucial to get help from a qualified tax consultant for accurate reporting and compliance with tax laws.

Key Tips for Smooth Tax Filing:

1. Keep Good Records: Keep track of your income, expenses, and investments throughout the year. This makes tax filing easier and helps you claim deductions.

2. Seek Expert Help: Consider hiring a professional tax consultant, like Alliance Tax Experts, for personalized advice and accurate filing.

3. Plan for Savings: Look into deductions, exemptions, and investments to reduce your tax burden legally.

4. File On Time: Meet the deadlines for filing your tax returns and paying any taxes owed to avoid penalties.

5. Stay Informed: Stay updated on tax regulations and changes to make informed decisions about your finances.

Conclusion:

Filing taxes is a legal requirement that requires attention to detail. By understanding the due dates, seeking expert help, and following best practices, you can ensure a smooth filing experience. For personalized assistance, contact Alliance Tax Experts at 9769201316 or email santoshpatil@alltaxfin.com.

#IncomeTaxFiling #TaxConsultant #TaxReturn #AuditFiling #TaxFilingTips #TaxCompliance #AllianceTaxExperts #SelfEmployed #Proprietors #PartnershipFirms #PvtLtdCompany #Freelancer #Professionals