04 Oct

EVERTHING ABOUT ADVANCE TAX

Advance Tax Payment

The financial

year begins on April 1. The taxpayer then expects to estimate how much income

you are going to earn this year, the net profit. After estimating this, advance

tax is paid accordingly. If the taxpayer's income is to be taxed on a large

scale, it is not possible to pay it at the end of the financial year on the 1st

of March or after that taxpayer. Assuming this, the government has suggested an

advance tax solution.

This tax can be

refunded if the income tax is paid in advance, assuming some income in the

financial year and the income is reduced by the end of the year. If income is

higher than the estimate of income and the income tax is more applicable, it

can be paid in the last stage of advance tax.

*What is an advance tax?*

Advance tax is

a percentage of the tax that is applicable to you before the end of the

financial year. The basic idea is to pay taxes as you earn. If you have to pay

more than Rs 10,000 in income in the financial year, or if you have a tax

liability, advance tax can be paid. Income tax is to be paid only in the

financial year.

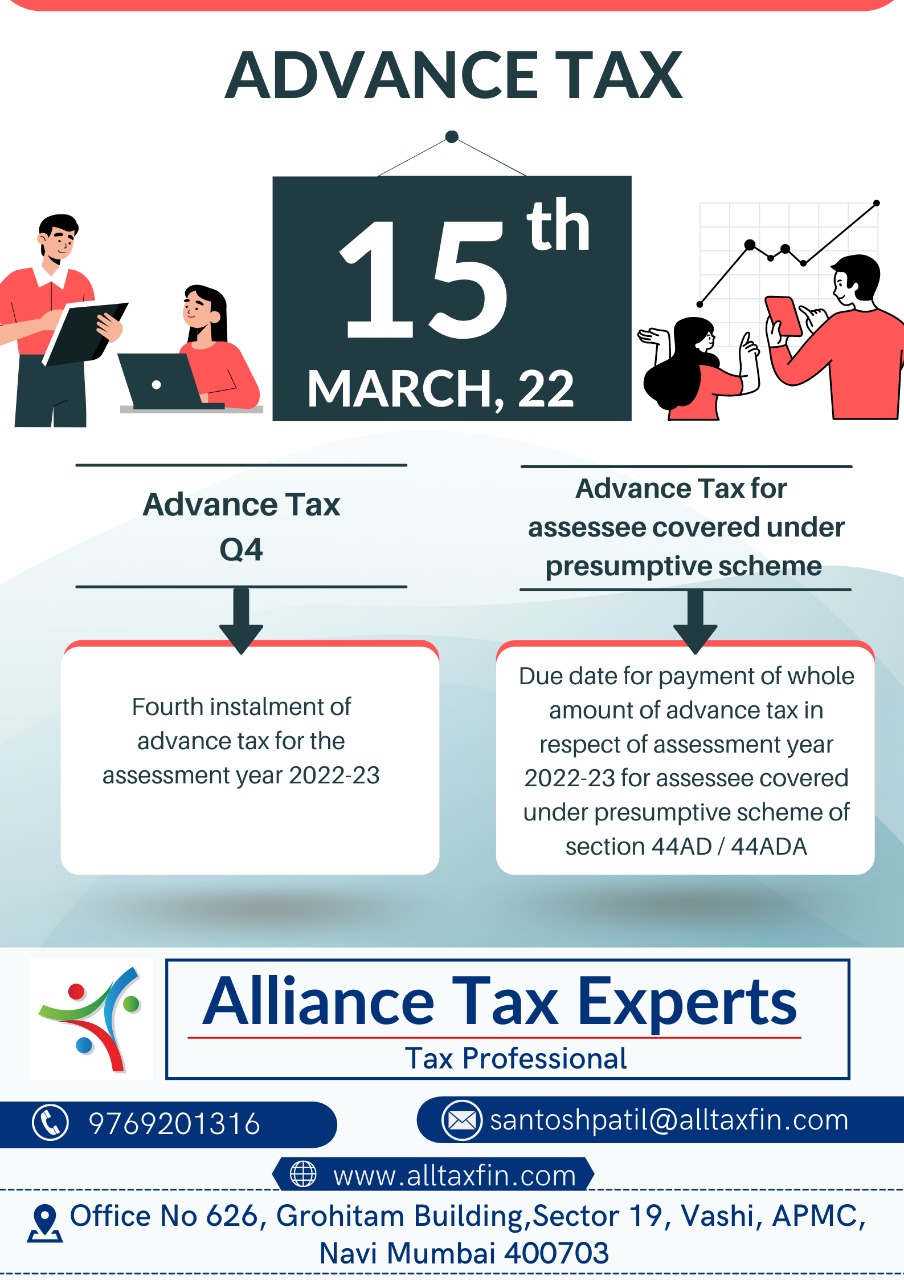

*Due Dates*

|

Date |

Advance Tax % |

|

15th June |

15% |

|

15th September |

45% |

|

15th December |

75% |

|

15th March |

100% |

*Penalty*

If the tax

filing dates are incorrect, the interest penalty is charged. Section 234C:

According to this clause, interest is to be paid for each instalment at 1% per

month. Section 234B: According to this section, interest is to be paid at the

rate of 1% per month for the month from April 1 to the date of payment of tax.

However,

you should contact early and pay your advance tax

Regards

Santosh Patil

Alliance Tax

Experts

9769201316

#advancetax,#incometax,#gst,#audit,#privatelimitedcompany,#limitedliabilitypartnership

#llp, #pvtltdcomp, ,#taxconsultant, #ca,#alliancetaxexperts,#accountant,#navimumbai