09 Oct

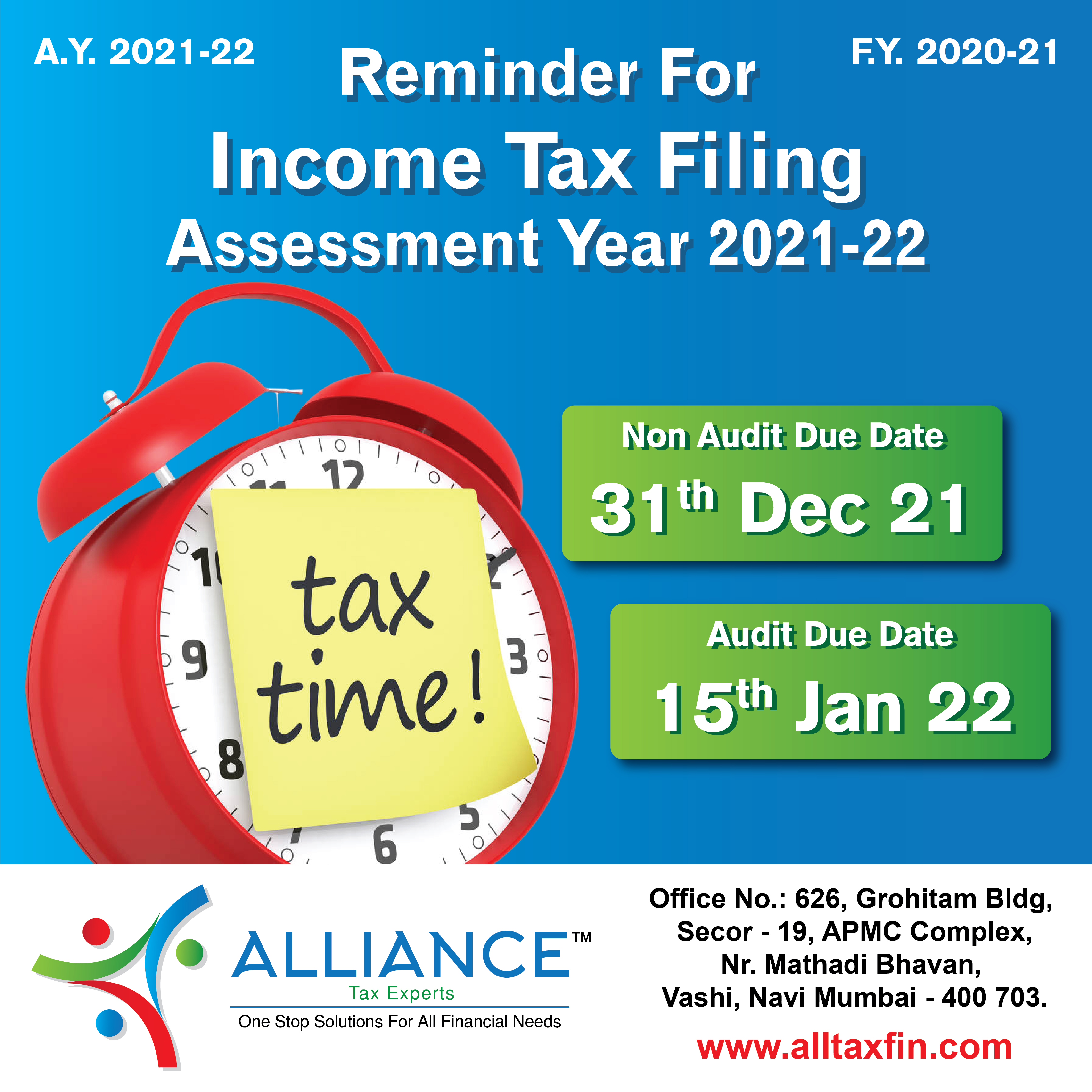

What is the last date for filing income tax AY 2021 2022

What is the last date for

filing income tax? ITR Deadline- FY 2020-21, AY 2021-22

The last date

for filing an income tax return is the date by which a return can be filed

without any delay charges or penalties. Taxpayers who have paid such an amount

will have to pay interest under section 234A and penalty under section 234F.

The

latest updates

The CBDT has

issued a circular on 09 September 21 extending the deadline for some direct tax

compliance for AY 2021-22.

1.

Filing of ITR due to extension of date:

i) The filing

of ITR by the taxpayers which is not covered by the audit has been extended

from 30th September 2021 to 31st December 2021.

ii) ITR

filing for tax audit cases has been extended till 15th February 2022

iii) Filing

of ITR for transfer price has been extended till 28th February 2022

iv) ITR for

filing delayed or revised returns for FY 20-21 has been extended from 31st

December 21 to 31st March 2022

2.

Furnishing audit report:

i) Deadline

for submission of the audit report has been extended to 15th January 2022

ii) The

deadline for submission of the audit report for transfer cost cases has been

extended to 31st January 2022

It is

important for all taxpayers to remember the last date for filing income tax

returns. The due date varies depending on the taxpayer. For example, salaried

individuals are usually required to file their income tax returns by July 31,

while corporate auditors involved in the audit may file their returns by

September 30 of the year.

Regards

Team Alliance

Tax Experts

#covid #income

#startup #taxprep #incometaxes #audit #itr #taxconsultant #castudents #cpa

#cafinal #taxtime #gstr #businessowner #creditrepair #gstupdates #gstindia

#businesstaxes #accountingservices #accountants #cs #gstregistration #taxpro

#incometaxrefund #cma #credit #gstreturns #refund #taxreturns #icsi

#alliancetaxexperts