13 Jun

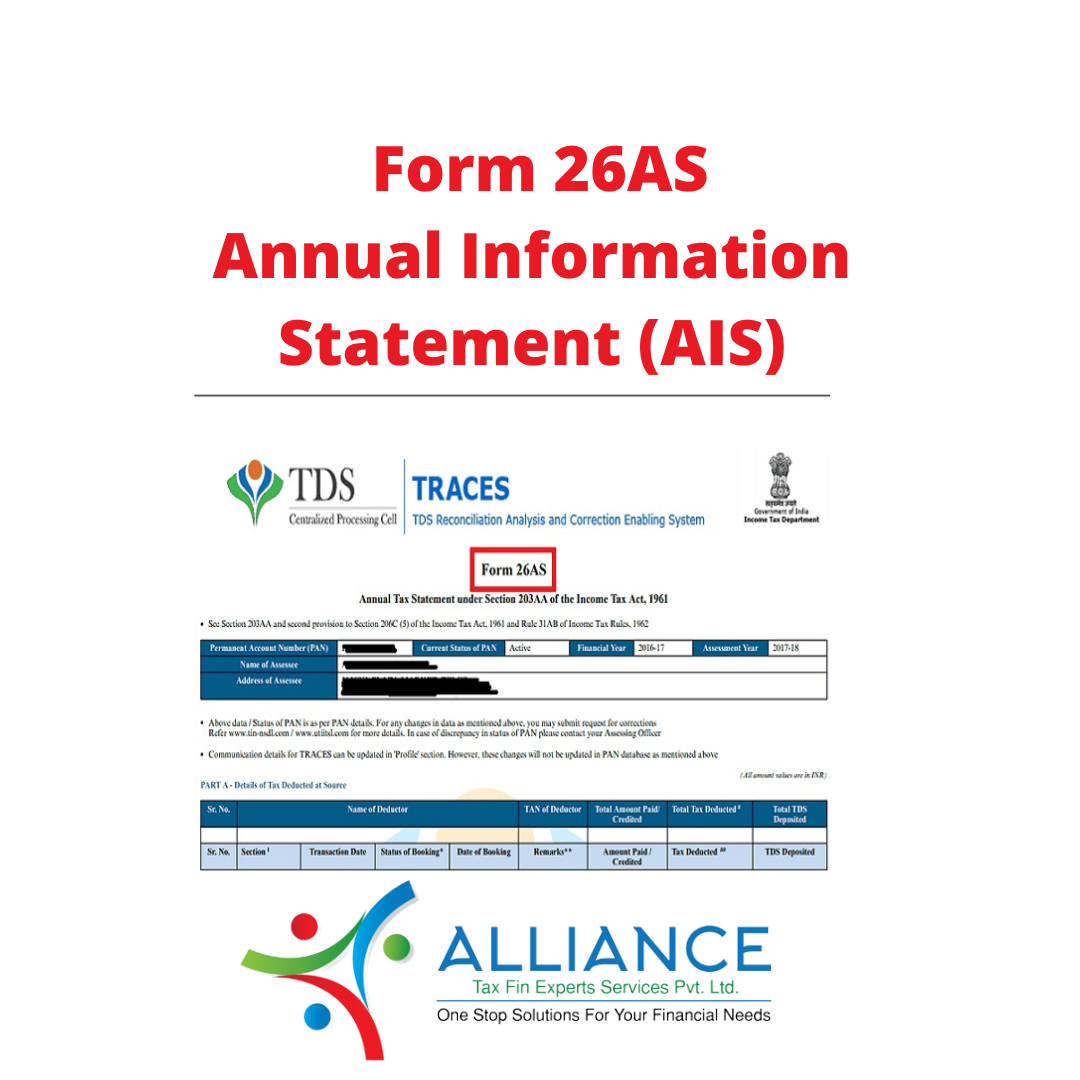

Form 26AS/ Annual Information Statement (AIS)

Form 26AS/ Annual

Information Statement (AIS)

Form 26AS/ Annual

Information Statement (AIS) is an annual statement that the tax department will

use to reflect the transactions of taxpayers. This form is filed by taxpayers voluntarily.

Form 26AS is an annual

information statement provided to the income tax department by banks, mutual

funds and other financial institutions for transactions valued above Rs 5 lakh

in a financial year. The report provides data in categories such as holding and

transfer of shares, debits and credits from/to savings accounts, credit from

individual to non-resident and non-individual accounts, interest on fixed

deposits & term deposits, etc.

Following are the SFT

reference numbers:

SFT-001: Buy Bank Draft or Pay Order in Cash

SFT-002: Cash purchase of pre-paid equipment

SFT-003: Deposit cash in the current account

SFT-004: Cash Deposits in Accounts Other than

Current Accounts

SFT-005: FD

SFT-006: Payment for Credit Card

SFT-007: Sale / Purchase of Debentures

SFT-008: Sale / Purchase of Shares

SFT-009: Buy Back Shares

SFT- 010: Sale / Purchase of MF

SFT-011: Sale / Purchase of Foreign Currency

SFT-012: Sale / Purchase of Real Estate

SFT-013: Cash payment for goods and services

The Income Tax Department

has obtained all the above information from various financial institutions and

banks, Mutual Funds, SEBI, Registrar of Assets, Sub-Registrar etc. since the

financial year 2016. This is called a 'high-value transaction'.

These transactions are now

shared and summarized in your Income Tax Portal in your 26AS or AIS. You can

easily download and review these reports. Assessors must be aware of the

content in this form and report appropriately in ITR (even if there is zero

tax/loss).

For example, trading

transactions related to shares or stocks are reflected in the AIS report.

Failure to disclose F&O / intraday / shortshort-term/long-termsactions in

the ITR will result in discrepancies and will result in a notice in which the

tax department will be required to provide all the details.

The recommended approach is

that all data (including foreign assets such as RSUs / ESOPs / foreign shares)

have been properly clarified and reported in the ITR. This will prevent future

checks and troubles. Once a mistake is made, a detailed investigation is then

carried out by the ITD. So, good to follow!

Regards

Santosh Patil

CEO & Founder

Alliance Tax Experts

9769201316

#incometaxfiling

#incometaxfilingindia #incometaxfilingdate #incometaxfilingexperts

#incometaxfilingreturn #incometaxfilingonline #incometaxfilingservice

#incometaxreturns #incometaxupdates #form26as #form26asfortaxpayers #ais

#annualinformationsystem