08 Sep

Missed filing ITR for the last 2 years

Missed filing ITR for the last 2 years?

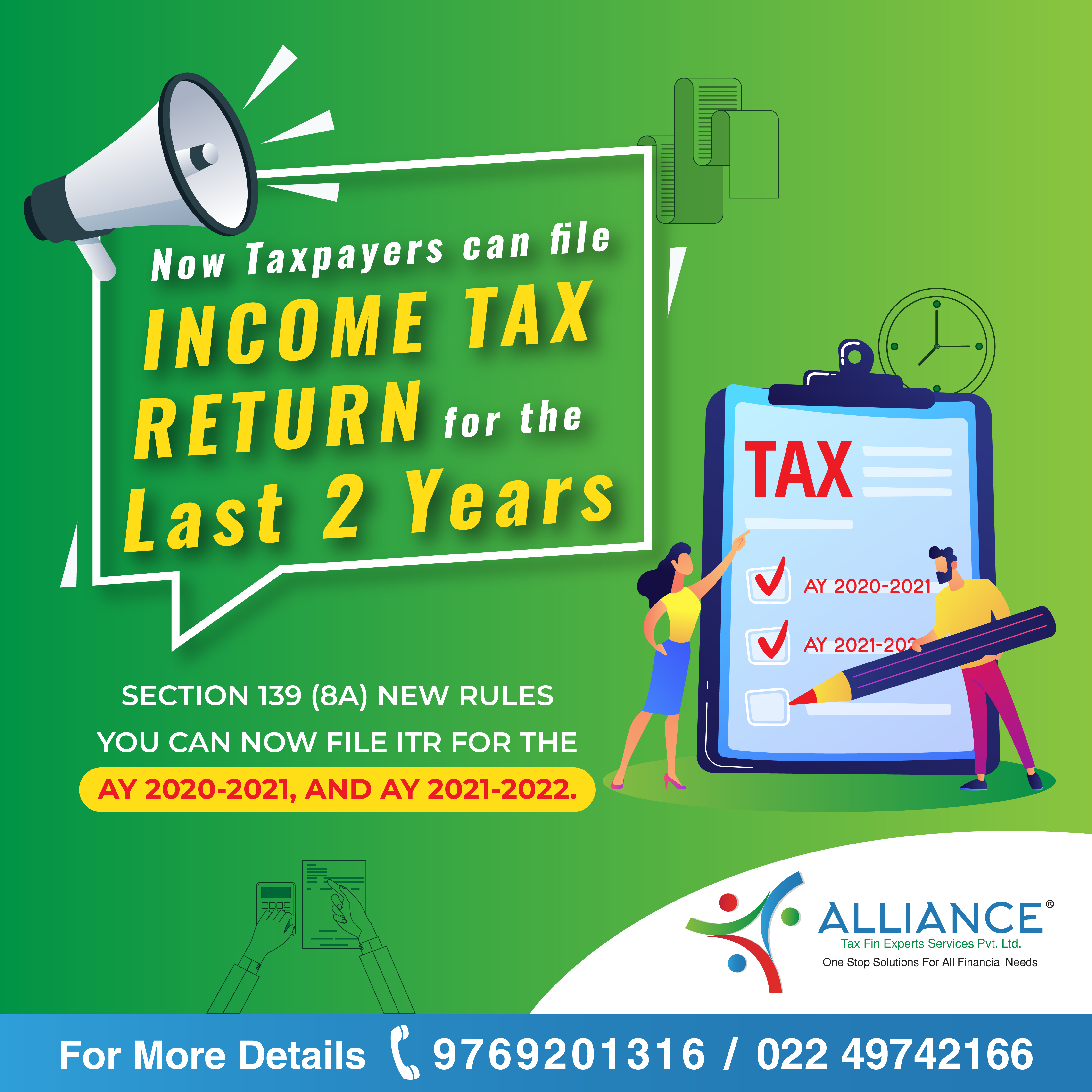

Now taxpayers can file ITR for the last 2 years

The Income tax department has introduced a new rule that you

can file your income tax return for the last two years. Also, you will have to

pay a penalty if you fail to file.

If any taxpayer is missed to file ITR due to Corona and some

other reasons, now they can file it. Earlier the taxpayer could file only for

the current i.e., AY 2022-2023

Under the income tax department, updated return under Section

139(8A) new rules you can now file ITR for the AY 2020-2021, and AY 2021-2022.

Some conditions have been put in this

The taxpayer will have to pay a penalty for this

Benefits of ITR

1) Useful for taking loans

2) ITR has to be filed to avoid income tax department notices

in future

3) Credit is created

If you need any advice to file your ITR, you can contact our

team

Our ITR experts will help you with your ITR!

Alliance Tax Experts

9769201316

alliancetaxexperts@gmail.com

#tax #help #corona #itrfiling #alliancetaxexperts #taxconsultant #charteredaccountant #accounting