16 Apr

The Income Tax Department identified 1.52 crore non-filers and initiated action

The Income Tax Department identified 1.52 crore non-filers and initiated action

The IT department has identified 1.52 crore individuals who have income or have tax deducted at source (TDS) but have not filed their returns.

An official said that in the financial year 2022-23, there were about 8.9 crore taxpayers, while those who filed returns were 7.4 crore.

The Income Tax Department will launch a drive against individuals and organizations who are required to file their Income Tax Return (ITR) but have not done so.

The IT department has identified 1.52 crore individuals who have income or have deducted tax at source (TDS) but have not filed their returns, reported the Economic Times.

According to reports, the Central Board of Direct Taxes (CBDT) has asked field formations to contact such defaulters from April 15.

An official told the website that in the financial year 2022-23, there were about 8.9 crore taxpayers, while those who filed returns were 7.4 crore. The number of returns includes revised returns, the official said.

As a result, there were possibly 1.97 crore people who did not file ITR despite deducting tax at source. Of the non-filers, 1.93 crore were in the individual category, 28,000 were from Hindu undivided families and 1.21 lakh were from companies, while the rest were in various other categories.

Identification of non-filers:

Parameter Number of non-filers

1.93 crore persons

Hindu Undivided Families (HUFs) 28,000

Firm 1.21 lakhs

The rest of the categories

According to the official, bank transactions linked to PAN were too high, hence the filing of ITR was necessary, the report said.

Major actions taken:

Description of action

1) Communication with non-filers Affected taxpayers have been contacted through email to correct their returns.

2) Field Outreach Field officers are tasked with reaching out to non-filers to explain the importance of filing ITR.

3) Sending tax notices to potential defaulters Tax notices have been sent to approximately 8,000-9,000 potential taxpayers with high-value transactions.

The field officers have been asked to contact such persons with proper data and information and explain why they need to file their ITR.

CBDT has data that tax notices are being sent to around 8,000-9,000 potential taxpayers against whom the department has excess ticket purchases or excess cash deposits.

If they are found to be willful defaulters, such persons will have to pay a penalty. But taxpayers who have bona fide reasons for sudden income will have to explain or file a return.

The Income Tax Department is also banking on the massive amount of data it has received which has helped identify such non-filers and detect any anomalies.

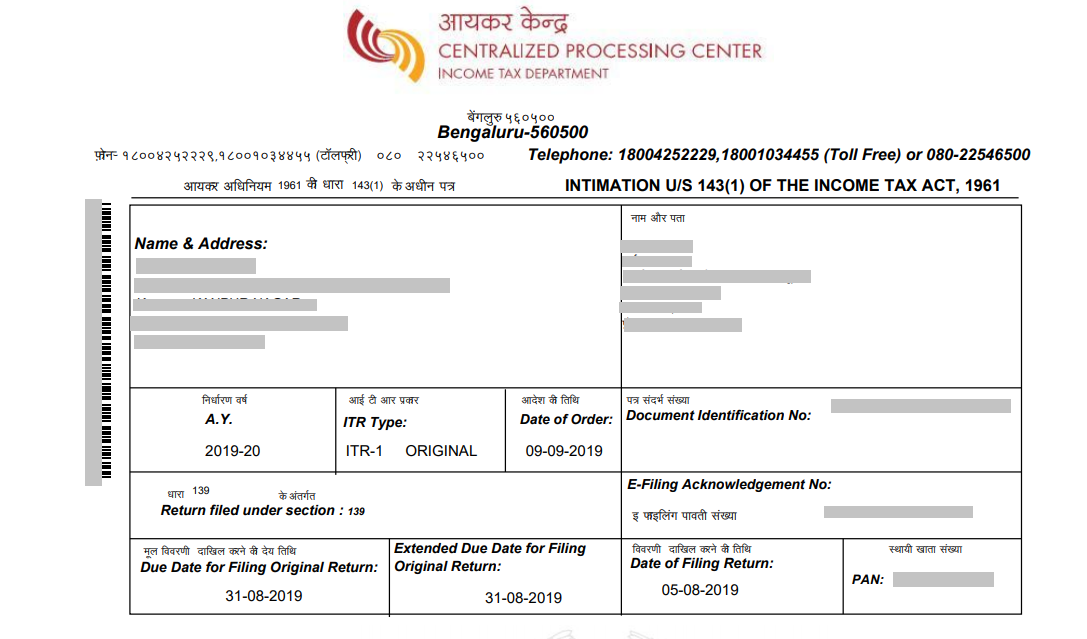

#incometax #incometaxnotice #incometaxnotice143(1)(a) Incometaxnotice143(2) #incometaxreturn #alliancetaxexperts #taxconsultant #gstconsultant