28 Mar

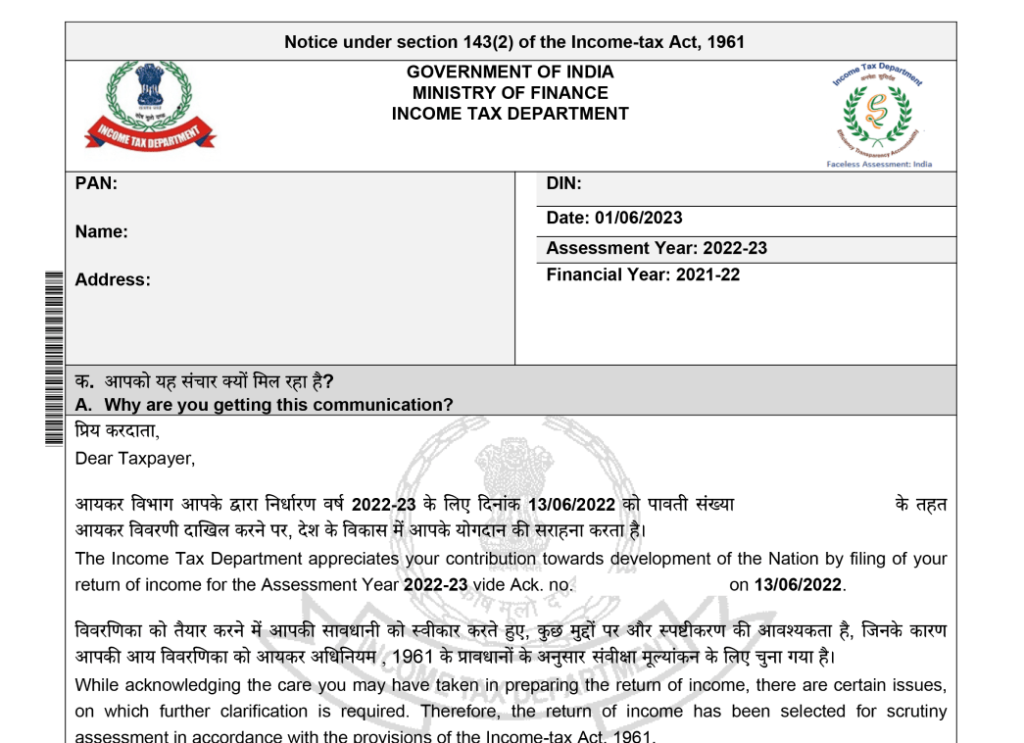

Understanding the Income Tax Scrutiny Process: A Guide for Taxpayers

Understanding the Income Tax Scrutiny Process: A Guide

for Taxpayers

Hey Taxpayers! Ever wondered what happens if the tax department finds issues

with your returns? We've got you covered! From receiving a notice to appealing

to the Income Tax Appellate Tribunal, here's a simple guide to help you

understand the assessment process. Stay informed and make sure your taxes are

in order!

We want to make sure you're clear about how the Income

Tax Department assesses your tax returns if they find any discrepancies. Here's

a simple guide:

1.

Filing Your Tax Return:

- You start

by filing your tax return with the Income Tax Department.

2.

Noticing Discrepancies:

- If the tax

department spots any issues in your returns, they'll send you a notice to

address them.

3.

Responding with Documents:

- Once you

get the notice, it's important to reply quickly and provide all the necessary

documents to explain any discrepancies.

4.

Final Assessment under Section 143(3):

- After

reviewing your documents, the tax officer will make a final decision under

Section 143(3) about your tax situation: whether you owe tax, are owed a

refund, or owe nothing.

5.

Appealing to the Commissioner:

- If you

disagree with the decision under Section 143(3), you can appeal to the

Commissioner.

6.

Taking It to the Income Tax Appellate Tribunal (ITAT):

- If you're

still not satisfied after appealing to the Commissioner, you can take your case

to the Income Tax Appellate Tribunal (ITAT).

#IncomeTax #TaxReturns #TaxAssessment #TaxpayersGuide #ITATAppeal #StayInformed